As we begin a new decade and build upon the strong momentum the multifamily market has developed over the past 10 years or more, let’s take a look where the sector is headed.

Experts have predicted the following multifamily trends for 2020 and beyond:

Research firm CBRE highlights healthy growth in the suburban multifamily market that will outpace performance in urban centers. These areas will enjoy lower vacancy rates and post higher rent growth.

We have followed this trend for the past several years as more families seek the sense of community, safety and access suburban areas provide. In many cases, suburbs offer a live-work-play lifestyle that attracts renters across demographics – and often at a more affordable price than in downtown or city areas.

The Urban Land Institute has coined a term for this suburban growth trend: hipsturbia. In other words, millennials, GenZers, hipsters and other trendsetters have made these markets cool again. They want urban-style living in terms of access to transportation, restaurants, music and art, but with the space and comfort of a suburban landscape.

The Urban Land Institute’s Emerging Trends report for 2020 ranks several metro areas in the Southeast as the “top markets” for multifamily, including Raleigh-Durham and Charlotte. Atlanta, Orlando, Nashville, Austin and Dallas also consistently rank in the top tier for multifamily investment.

The entire Southeast region continues to attract new residents with strong economies, job opportunities and attractive climates and lifestyles. According to NREI:

“The number of people aged 20 to 34 in Southeastern U.S. is expected to grow by 1.5 percent per year over the next five years, according to data from the U.S. Census. That’s faster than in the U.S. overall, where the number of people aged 20 to 34 is expected to grow by just 1.0 percent over the same period.”

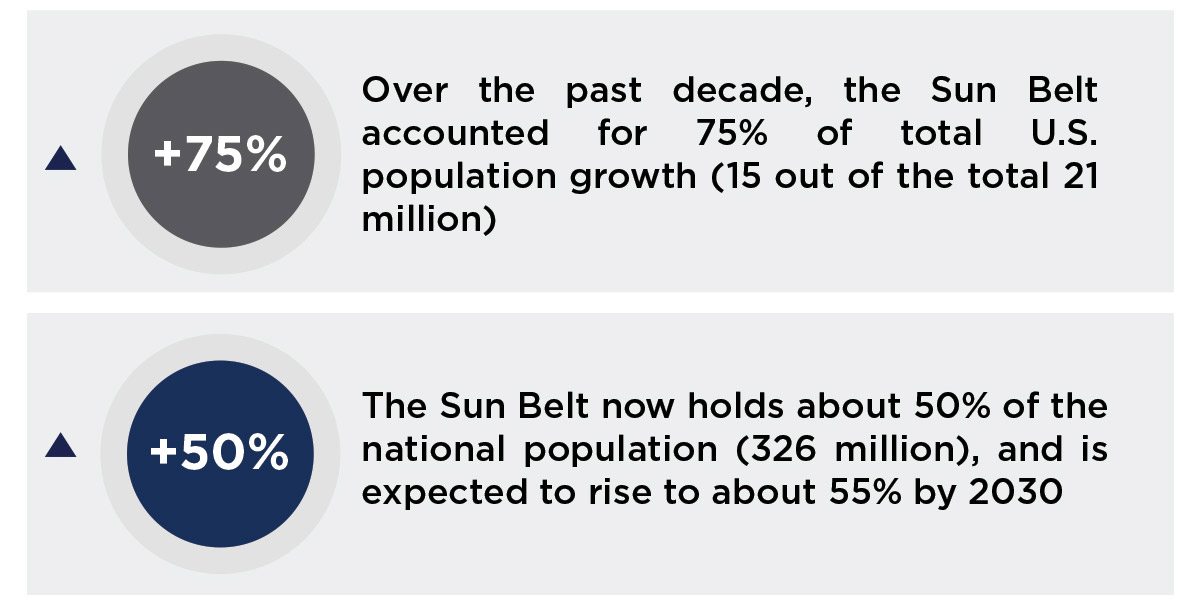

Known as the Sun Belt, the Southeast region draws people from the Midwest and other areas of the country who seek a lifestyle change and new employment options.

In a trend experts have called community-oriented development, people seek out areas to convene, collaborate and share resources, time and ideas. From open foodie marketplaces to coworking, development in 2020 will often focus around community centers.

Curbed calls this type of development “collaborative consumption” and describes it this way:

“…integrated platforms of products, services, and experiences—is increasingly popular with younger generations favoring sustainability and social interaction. As traditional retail continues to struggle, this type of business, or placemaking effort, can be a big draw for a larger project.”

Multifamily properties have a distinct opportunity to benefit from, and draw on, this trend as they contribute to the place-making efforts of metro areas across the country. Apartments are no longer simply about providing a space to call home and adding a few basic amenities. Renters are looking for a sense of purpose and connection within their communities.

As economists suggest there could be a potential economic downturn in the next few years, multifamily investment provides a level of protection. In fact, it offers investors one of the more stable options for diversifying their portfolios in the face of potential market volatility.

As GlobeSt. explains:

“Multifamily is the safest investment next year, particularly with rising fears of a recession. The asset class is more protected against downturns than any other asset class, making it a safe investment as the cycle matures.”

Even as consumer spending tightens and retailers downsize or close entirely during downturns, people continue to need homes. Demand for apartment homes continues throughout all economic cycles. If the economy should slow or correct in 2020, investors will feel a higher level of comfort with their multifamily investment than other products.

PointOne Holdings is a real estate investment firm headquartered in South Florida and Atlanta with properties located throughout the Southeastern United States and Texas. The firm owns and manages a diversified portfolio of residential and commercial assets valued in excess of $730 million. PointOne Holdings’ core principles are founded on precise investment selection, thorough due diligence, creative deal structuring, strong financial management and proactive and responsive communication. PointOne Holdings’ principals are seasoned professionals with over 40 years of combined experience who have collectively conducted over $2 billion in real estate transactions.